If you’ve ever wondered how much money you need to invest to make $3,000 a month, you’re not alone. Building passive income is one of the most sought-after financial goals for those pursuing financial freedom or early retirement.

To generate a steady $3,000 per month — or $36,000 per year — your required investment depends on several key factors, including return on investment (ROI), risk tolerance, and the type of assets you choose. Whether you prefer dividend stocks, real estate investing, bonds, REITs, or index funds, each option offers a different balance between potential returns and risk exposure.

For example, if your portfolio yields an average annual return of 6%, you’d need roughly $600,000 invested to achieve $3,000 monthly. Lower-risk assets like bonds or high-yield savings accounts may demand a significantly larger investment, while higher-risk vehicles, such as growth stocks or cryptocurrency, could yield faster results—but with greater volatility.

Understanding compound interest, portfolio diversification, and tax-efficient investing is also crucial for maximizing returns while minimizing risk. This guide will break down exactly how much capital you need for different investment strategies, explain the math behind passive income, and help you design a personalized plan to reach consistent $3,000 monthly earnings.

By the end, you’ll have a clear picture of how to align your financial goals, investment strategy, and income target to make your money work smarter for you.

Try the #1 AI Investment Platform for Free: Intellectia

Understanding the Basics of Investment Income

Investment income can originate from several sources, each with its own risk profile and expected return:

-

Dividends from stocks — regular payouts from companies’ profits

-

Interest from bonds — fixed income payments from governments or corporations

-

Rental income from real estate — steady cash flow from tenants

-

Business profits or side ventures — active or semi-passive income streams

Each income source behaves differently during market cycles. Combining multiple sources is the most reliable way to achieve consistent monthly income while managing risk.

Why Diversification Is Crucial

Diversification means spreading your capital across multiple asset classes to reduce risk. A single poor-performing investment won’t derail your entire portfolio.

By mixing stocks, bonds, real estate, and alternative investments, you gain exposure to different economic drivers — maximizing stability and long-term growth. This balance helps maintain income consistency even during volatile markets.

Key Factors That Determine How Much You Need to Invest

1. Expected Rate of Return

The higher your annual return, the less capital you’ll need to invest to earn $3,000 per month.

However, higher returns come with higher risk. Understanding historical performance helps set realistic expectations:

-

Bonds: 3–5% average annual return

-

Real estate: 6–10% (depending on leverage and location)

-

Stock index funds: 7–10% long-term average

-

Dividend stocks: 3–6% income yield

2. Risk Tolerance

Your risk tolerance defines how much volatility you can handle.

-

Conservative investors lean toward bonds and income funds.

-

Moderate investors balance dividend stocks, bonds, and real estate.

-

Aggressive investors prioritize stocks and growth assets with higher upside potential.

Assessing your comfort with losses helps you design a portfolio that feels sustainable during market downturns.

3. Investment Time Horizon

Time is your greatest ally. A longer investment horizon allows compounding to amplify returns.

For example, reinvesting dividends and interest over 15–20 years can multiply your total income without additional contributions.

4. Tax Efficiency

Taxes can significantly erode returns. Optimize for after-tax income by using:

-

Tax-advantaged accounts (IRAs, Roth IRAs, 401(k)s)

-

Municipal bonds (tax-free interest)

-

Tax-loss harvesting strategies

-

Dividend reinvestment within tax-deferred accounts

Best Beginner Investment Platform | How Much Money Do I Need to Invest Make 3000 a Month | How to Make 1000 a Month by Investing | How Much is 1000 a Month Invested for 30 Years | Should I Use Robinhood or Fidelity | Is Robinhood Worth It

The Math: How to Calculate the Required Investment

Use this simple formula to estimate your investment amount:

If you target a 4% annual return, the calculation is:

You would need approximately $900,000 invested at a 4% return to earn $3,000 per month.

However, always adjust for inflation, management fees, and market fluctuations to maintain real purchasing power.

Income-Generating Investment Options

Dividend Stocks

Dividend-paying stocks offer passive income plus potential capital appreciation.

Focus on companies with:

-

Long dividend track records

-

Sustainable payout ratios

-

Low debt and steady cash flow

Dividend reinvestment plans (DRIPs) compound your gains by automatically purchasing more shares.

Bonds

Bonds provide fixed income and stability. While returns are modest, they act as a buffer during stock market downturns.

Consider building a bond ladder—a mix of short-, medium-, and long-term bonds—to balance liquidity and yield.

Real Estate

Real estate remains a powerful income generator.

-

Rental properties provide monthly cash flow

-

REITs (Real Estate Investment Trusts) offer real estate exposure without management hassle

Analyze location, maintenance costs, and occupancy rates before investing.

Peer-to-Peer (P2P) Lending

Platforms like LendingClub or Prosper let you lend directly to borrowers for higher returns (6–10%), but risk is elevated.

Diversify across many loans and vet borrower credit scores to minimize defaults.

Alternative Investments

Other high-yield options include private credit, covered calls, royalties, or business partnerships. These can complement traditional assets for diversified income streams.

How to Build a Portfolio That Produces $3,000 a Month

-

Define Your Goals – Know your target income, timeframe, and risk profile.

-

Evaluate Your Current Finances – Measure your savings capacity and existing assets.

-

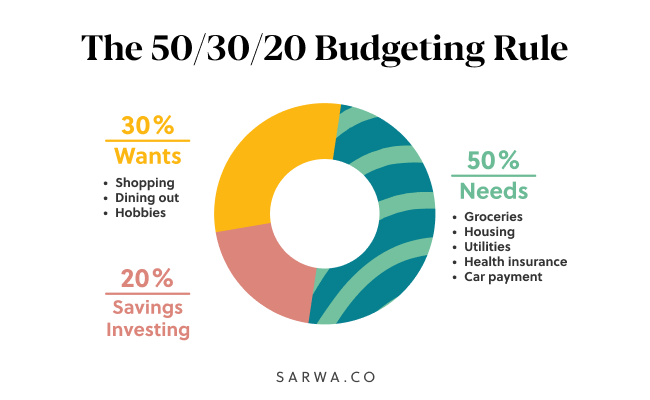

Create a Monthly Budget – Identify how much you can invest regularly.

-

Select the Right Mix – Combine dividend stocks, bonds, and real estate strategically.

-

Automate Contributions – Use automatic transfers to stay consistent.

-

Reinvest Earnings – Reinvest dividends and interest for compounding growth.

-

Monitor and Rebalance – Adjust asset allocations annually.

-

Seek Expert Advice – A licensed financial advisor can optimize tax strategy and risk exposure.

Example Portfolio for $3,000/Month Passive Income

| Asset Class | Allocation | Expected Return | Annual Income (on $900,000) |

|---|---|---|---|

| Dividend Stocks | 40% ($360,000) | 5% | $18,000 |

| Bonds | 25% ($225,000) | 4% | $9,000 |

| Real Estate / REITs | 25% ($225,000) | 6% | $13,500 |

| Alternatives (P2P, etc.) | 10% ($90,000) | 7% | $6,300 |

| Total | 100% ($900,000) | ~4.7% blended | $46,800/year ($3,900/month) |

This diversified structure provides income stability while maintaining long-term growth potential.

Try the #1 AI Investment Platform for Free: Intellectia | Intellectia AI Review

Final Thoughts

Earning $3,000 a month from investments is achievable with disciplined planning, diversification, and time.

Start early, reinvest earnings, and review your strategy regularly to ensure you stay on course. With consistent effort, you can build a reliable stream of passive income and move closer to financial independence.

Frequently Asked Questions (FAQ)

How long will it take to build a $900,000 investment portfolio?

It depends on your monthly contributions and return rate. Investing $2,000/month at an average 7% annual return will take roughly 18–20 years to reach $900,000.

Can I make $3,000/month with less than $900,000?

Yes, if you achieve a higher return rate. For example:

-

At 6% return, you’d need $600,000

-

At 8% return, about $450,000

Higher returns, however, mean taking on more risk.

Is real estate better than stocks for passive income?

Real estate provides stable cash flow and potential appreciation, while stocks offer liquidity and lower management burden. A mix of both often yields the best results.

Should I live off dividends or sell investments?

Both approaches work. Living off dividends provides stable income without reducing principal. Selling shares (a “total return strategy”) allows more flexibility but requires careful withdrawal planning.

How do taxes affect my investment income?

Taxes vary by asset type and account. Holding investments in tax-deferred accounts (IRA, 401(k)) or using municipal bonds can reduce or defer tax liability, boosting after-tax returns.