The rise of commission-free trading has completely changed how people invest, and Robinhood has been at the center of that revolution. Launched in 2013, Robinhood quickly became one of the most popular investment apps in the U.S., attracting millions of beginner investors with its zero-fee trading, sleek mobile platform, and easy access to stocks, ETFs, options, and even cryptocurrency. But as the platform continues to grow, many investors ask the key question: Is Robinhood actually worth it for investing in 2025?

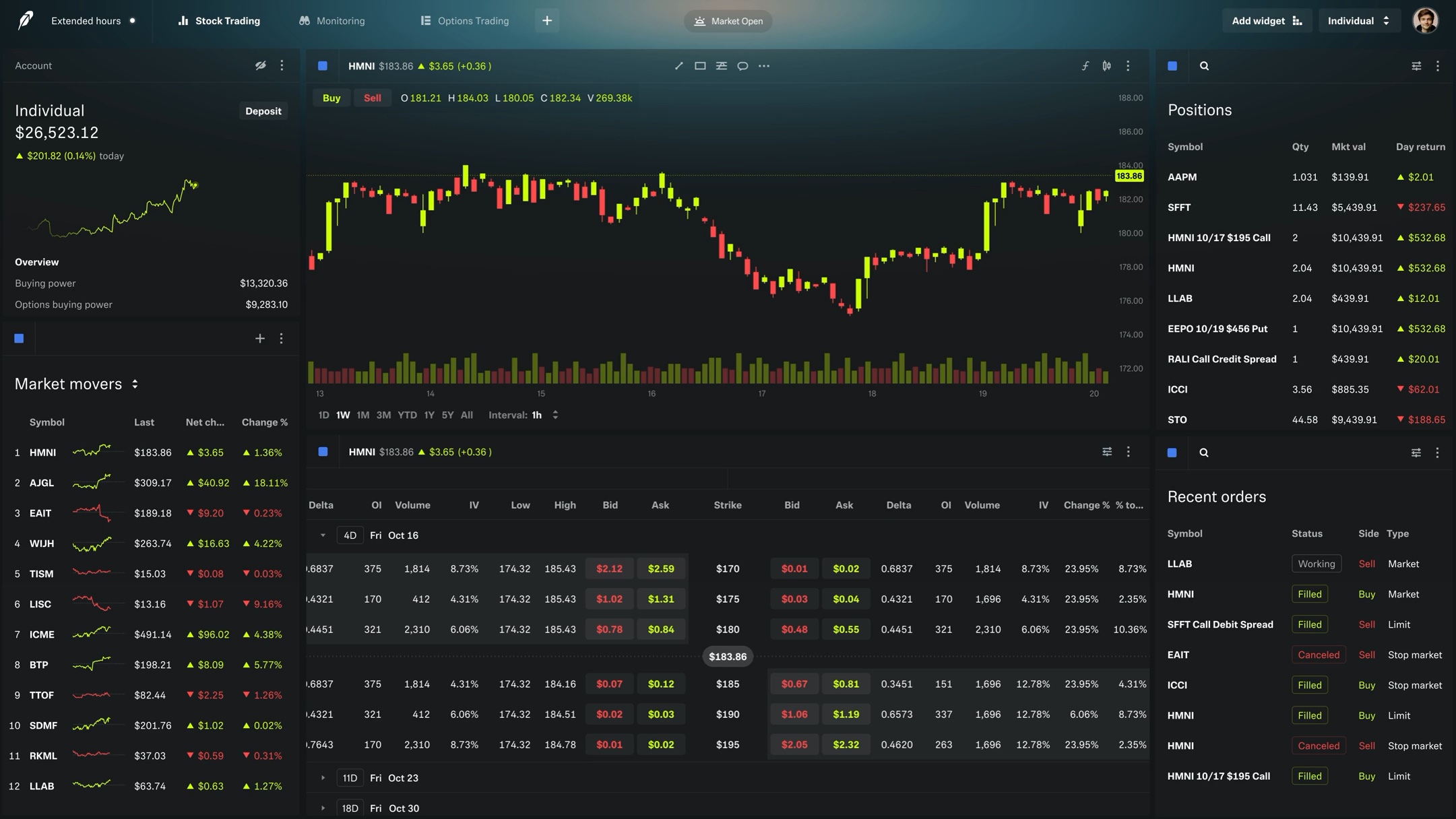

This in-depth Robinhood review explores the app’s pros and cons, including its trading tools, research features, and security measures. The platform’s appeal lies in its simplicity — users can buy and sell stocks in seconds, invest with as little as $1, and access real-time market data without complicated fees. However, Robinhood’s limited research resources, lack of retirement accounts, and concerns over customer support and payment-for-order-flow practices may make some investors cautious.

Whether you’re a beginner investor looking for your first brokerage account or a more experienced trader seeking low-cost investing, understanding Robinhood’s full suite of features is essential. This review breaks down what sets Robinhood apart, what drawbacks exist, and ultimately, whether it deserves a place in your investment strategy today.

Try the #1 AI Investment Platform for Free: Intellectia

Introduction: The Rise of Robinhood

In recent years, Robinhood has become a household name in the world of stock trading and investing. Its simple, user-friendly interface has attracted millions of users, especially those new to the world of investing. But is Robinhood truly worth it for your investment needs? In this review, we'll take a closer look at Robinhood's features, pros and cons, and what users are saying about it.

What Is Robinhood?

Robinhood is a popular investment app that allows users to trade stocks, options, ETFs, and cryptocurrencies without paying any commissions. Founded in 2013, its mission is to democratize finance for all, making investing accessible to everyone.

Robinhood’s Mission and Growth

With its sleek, easy-to-navigate mobile app, Robinhood has gained a massive following, especially among millennials and novice investors. Since its inception, it has revolutionized the way people think about investing and forced traditional brokers to adapt.

Who Uses Robinhood?

Robinhood's primary audience consists of young, tech-savvy individuals who are comfortable navigating digital platforms. Many of its users are first-time investors who appreciate the app's straightforward design and low barrier to entry.

How Robinhood Makes Money

Robinhood operates on a unique business model. While it does not charge commissions for trades, it generates revenue through:

-

Payment for order flow

-

Interest on uninvested cash

-

Robinhood Gold premium service

This model allows the platform to keep user costs low while maintaining profitability.

Key Features of Robinhood

Commission-Free Trading

One of Robinhood's standout features is its commission-free model. Unlike traditional brokers, it does not charge fees for buying or selling stocks.

Impact on the Industry

This innovation pressured legacy brokers to lower their fees, benefiting investors across the market.

Potential Downsides

While the lack of commissions encourages trading, it can also lead to impulsive behavior. New investors should approach with discipline to avoid overtrading.

Fractional Shares: Invest with Small Amounts

With Robinhood, you can invest in fractional shares, allowing you to own a portion of expensive stocks like Amazon or Tesla.

Accessibility and Diversification

Fractional shares make investing in premium companies possible with limited capital. They also enable better diversification across industries.

Educational Benefits

Novices can experiment with small sums to understand market movements before investing larger amounts.

Robinhood Gold: Premium Subscription

Robinhood Gold is a paid tier offering margin trading, larger instant deposits, and Morningstar research reports.

Margin Trading and Risks

While margin trading can amplify gains, it also increases exposure to losses. Investors must understand these risks before using leverage.

Morningstar Research Access

Gold subscribers receive professional-grade insights, enhancing decision-making for active traders.

Is It Worth It?

For investors seeking professional research and more capital flexibility, Robinhood Gold can be valuable, but beginners may not need it.

Guides

Best Beginner Investment Platform | How Much Money Do I Need to Invest Make 3000 a Month | How to Make 1000 a Month by Investing | How Much is 1000 a Month Invested for 30 Years | Should I Use Robinhood or Fidelity

Cryptocurrency Trading

Robinhood allows commission-free trading of popular cryptocurrencies like Bitcoin, Ethereum, and Dogecoin.

Accessibility and Simplicity

Its streamlined interface makes crypto investing approachable for beginners.

Risks of Crypto Trading

Crypto markets are volatile; investors must understand the associated risks before diving in.

Robinhood Pros

-

User-Friendly Interface: Ideal for beginners

-

Commission-Free Trading: Save on fees

-

Fractional Shares: Accessible investing in top stocks

-

Crypto Trading: Buy and sell digital assets easily

-

Instant Deposits: Quick access to trading funds

Robinhood Cons

-

Limited Investment Products: No mutual funds or bonds

-

Customer Support Issues: Reports of slow responses

-

No Retirement Accounts: Lacks IRAs or 401(k)s

-

Potential for Overtrading: Simplicity may encourage impulsive decisions

-

Limited Research Tools: Basic analysis in free version

User Experience and Reviews

Positive Feedback

Users praise Robinhood’s clean design, easy navigation, and cost-free trading. Crypto integration is also a major plus.

Common Complaints

Negative reviews often cite poor customer support, limited investment options, and lack of research tools for advanced traders.

Who Should Use Robinhood?

Best for Beginners

Robinhood’s simplicity, fractional shares, and educational tools make it ideal for new investors looking to learn the ropes.

Not Ideal for Advanced Traders

Experienced investors may find the lack of detailed analytics, mutual funds, and bonds restrictive for complex portfolio strategies.

Is Robinhood Worth It? Final Verdict

Robinhood has transformed the brokerage industry by pioneering commission-free trading and a user-first experience.

For beginners, it’s an excellent entry point into investing thanks to its ease of use and affordability.

However, advanced investors seeking comprehensive tools and investment options may prefer traditional brokers.

Ultimately, whether Robinhood is worth it depends on your investing experience, goals, and preferred trading style.

Try the #1 AI Investment Platform for Free: Intellectia | Intellectia AI Review

FAQ: Robinhood Investing - What You Must Know

1. Is Robinhood safe to use?

Yes. Robinhood is regulated by FINRA and the SEC and provides SIPC insurance up to $500,000 for securities (including $250,000 for cash).

2. Does Robinhood charge hidden fees?

No trading commissions are charged, but certain services—like margin trading under Robinhood Gold—come with fees.

3. Can I buy fractional shares on Robinhood?

Yes. You can invest in fractions of expensive stocks, allowing portfolio diversification with smaller amounts.

4. Does Robinhood offer retirement accounts?

Currently, Robinhood does not support IRAs or 401(k)s, so it’s better suited for taxable investing.

5. Can I trade crypto on Robinhood?

Yes. Users can buy and sell cryptocurrencies like Bitcoin, Ethereum, and Dogecoin directly through the app.

6. Is Robinhood Gold worth it?

It can be, if you want access to margin trading, larger deposits, and professional Morningstar research. For casual investors, the free version is sufficient.