Investing $1,000 a month for 30 years is one of the most effective ways to build long-term wealth and achieve financial independence. With consistent monthly investments and the power of compound interest, your money has decades to grow, turning a manageable contribution into a substantial investment portfolio.

But how much could that really be worth after 30 years? The answer depends on several key factors—interest rate, investment strategy, and market returns.

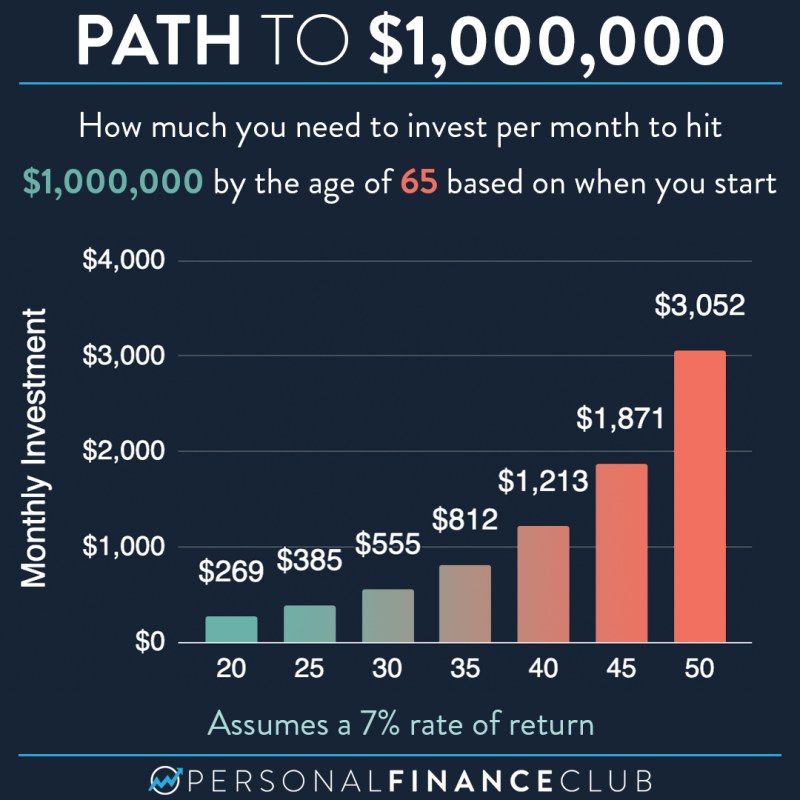

If you invest $1,000 per month with an average annual return of 7%, your total contributions of $360,000 could grow to over $1.2 million thanks to compounding. This demonstrates why long-term investing in stocks, index funds, or retirement accounts such as a 401(k) or IRA can significantly amplify your wealth over time. The earlier you start, the greater your compound growth, since returns start generating their own returns year after year.

Understanding how to maximize your investment returns involves balancing risk tolerance, choosing diversified asset allocations, and staying consistent—even during market fluctuations. This guide breaks down exactly how much $1,000 invested monthly for 30 years could grow under various scenarios, helping you design a winning investment plan. Whether you’re saving for retirement, financial freedom, or future generational wealth, consistent investing remains one of the smartest moves you can make.

Try the #1 AI Investment Platform for Free: Intellectia