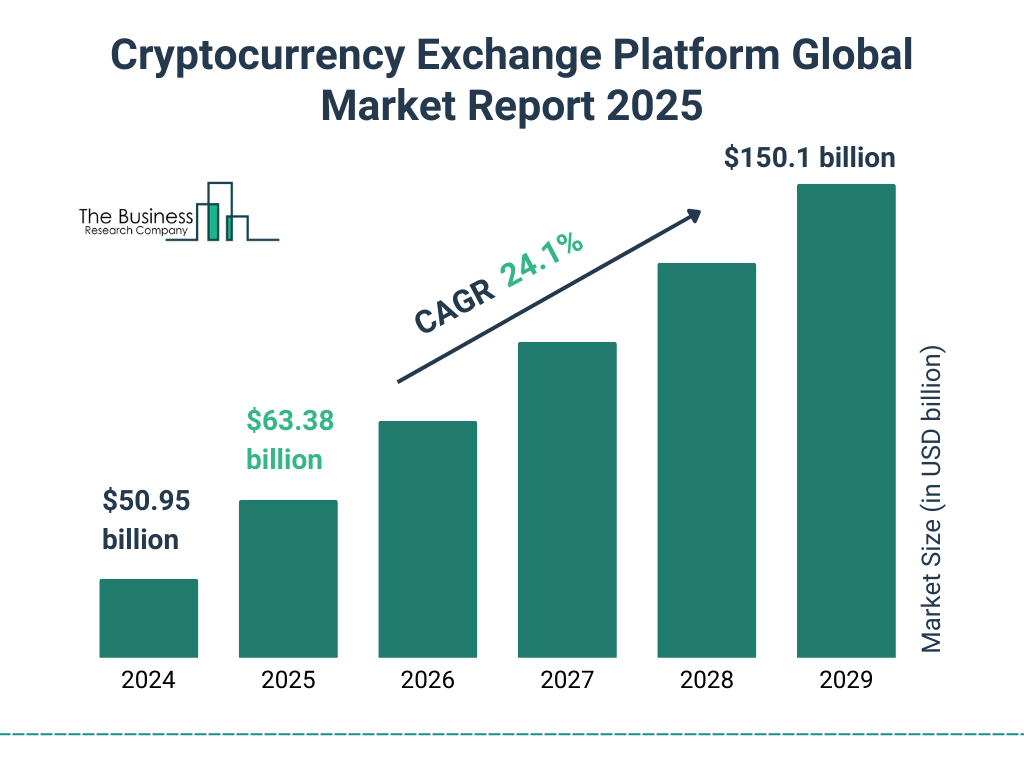

Scaling a crypto exchange business in 2025 is both an exciting opportunity and a formidable challenge. With global crypto adoption surging past 580 million users and trading volumes breaking records, the demand for robust, high-performance platforms has never been greater. Drawing from years of hands-on experience in the digital asset industry, I’ve seen firsthand how exchanges that prioritize scalability, security, and liquidity consistently outperform their competitors.

To truly scale, your exchange must be built on a scalable architecture that can handle massive spikes in transaction volume without sacrificing speed or reliability. This means leveraging cloud infrastructure, optimizing database management, and deploying advanced trading engines that keep latency low even during market surges. But technology is just one piece of the puzzle.

Equally vital is a relentless focus on regulatory compliance and risk management. Integrating robust KYC/AML protocols not only protects your users but also builds the trust needed to attract institutional clients and global partners. To stay competitive, you must continually enhance your feature set—think margin trading, staking, and DeFi integrations—while maintaining airtight cybersecurity to safeguard user assets.

Ultimately, scaling a crypto exchange is about more than just growth; it’s about creating a resilient, future-proof business that delivers value, trust, and seamless performance to every user. In this guide, I’ll share proven strategies and actionable insights to help your exchange thrive in today’s fast-evolving crypto landscape.

Discover the Best Hardware Crypto Wallet

Understanding the Crypto Exchange Landscape

The crypto exchange landscape is dynamic and rapidly evolving. Recognizing trends and shifts is crucial for staying competitive. It requires a deep dive into market conditions and user behavior.

Different types of exchanges cater to varied needs. Centralized exchanges dominate the market but have security risks. Decentralized exchanges offer greater privacy but may lack liquidity.

Key features of top exchanges often include:

- User-friendly interfaces for ease of use.

- Enhanced security protocols to safeguard assets.

- Diverse trading pairs and assets for more options.

Market opportunities are abundant. Identifying niche segments can be profitable. Focus on underserved regions or specialized services can drive growth.

Competition is intense among the biggest exchanges. Analyzing competitors helps understand strengths and weaknesses. Adopting best practices from successful players is wise.

Adapting to technological advancements is necessary. Incorporating AI and blockchain innovations can enhance services. Staying updated ensures your platform remains relevant.

Overall, understanding the current landscape is the first step in planning effective strategies. This knowledge equips you to navigate challenges and seize opportunities. It paves the way for developing a robust crypto exchange.

Key Challenges in Scaling a Crypto Exchange

Scaling a crypto exchange involves unique challenges. Understanding these hurdles is vital for successful growth. New entrants often face fierce competition.

Regulatory compliance can be complex and varies by region. It’s crucial to navigate different laws and guidelines. Compliance ensures operational legality and builds trust.

Security threats are a constant concern. Exchanges must invest in robust security measures. This helps protect user data and assets from cyberattacks.

Scalability of technology infrastructure is essential. High volumes of transactions require advanced systems. Downtime can severely impact user trust and reputation.

Maintaining liquidity is another challenge. Without sufficient liquidity, exchanges can’t offer seamless trading. It’s important to attract market makers and maintain active trading.

Common challenges include:

- Regulatory hurdles and compliance requirements.

- Protecting against sophisticated security threats.

- Ensuring sufficient technology capacity.

- Managing liquidity for active trading.

- Staying competitive and innovative in a fast-paced market.

Overcoming these challenges requires careful planning and execution. Strategies should be aligned with long-term goals. Proper resource allocation is key to scaling successfully.

INTELLECTIA AI - Get Free Market Intelligence for Crypto, Stocks, & ETFs

Regulatory Compliance and Legal Considerations

Navigating regulatory landscapes is crucial for crypto exchanges. Each country has its own set of rules. Adhering to these is non-negotiable for legal operation.

Regulation ensures exchanges have the trust of users and partners. Ignoring compliance can result in severe penalties and loss of business. Therefore, understanding local and international laws is essential.

A thorough legal framework aids in minimizing risks. It helps in protecting user funds and personal information. Legal teams should regularly update compliance protocols.

Anti-money laundering (AML) and know your customer (KYC) processes are fundamental. These protocols prevent illegal activities and fraud. Exchanges must verify user identities and monitor transactions.

Licensing requirements vary across regions. Obtaining the necessary licenses reinforces credibility. Exchanges must stay informed about changes in regulatory standards.

Key legal considerations include:

- Adherence to local and global laws.

- Implementation of AML and KYC procedures.

- Acquiring necessary licenses and approvals.

- Regular audits and compliance checks.

- Developing a proactive legal strategy for upcoming changes.

Keeping up with regulatory changes is vital. This includes monitoring geopolitical shifts and technology advancements. Adapting to these changes ensures sustained growth and market presence.

Building a Robust and Scalable Technology Infrastructure

Technology infrastructure is the backbone of any crypto exchange. It impacts speed, security, and user experience. A robust system supports seamless operations and growth.

Scalability is key to handling increased trading volumes. As the exchange grows, the technology must adapt to higher demands. A well-planned architecture ensures no bottlenecks.

Implementing a modular design offers flexibility. It allows easy updates and feature integration. This leads to a more dynamic and user-friendly platform.

Investing in reliable servers enhances performance and reduces downtime. Downtime can result in financial losses and user dissatisfaction. High availability is non-negotiable in this competitive market.

Moreover, redundancy systems are crucial for data protection. They prevent data loss during unforeseen failures. Ensuring data integrity earns user trust.

Security protocols should be ingrained at every level. This includes encryption, firewalls, and regular penetration testing. Cybersecurity must be a priority from the outset.

Streamlined processes facilitate rapid development and deployment. Continuous integration and delivery systems enable quick updates. This flexibility is essential for staying competitive.

Key infrastructure components include:

- Modular and scalable architecture design.

- High-performance servers and reduced latency.

- Redundancy systems for data protection.

- Advanced security protocols and regular testing.

- Continuous integration and delivery workflows.

High-Performance Trading Engines and Matching Systems

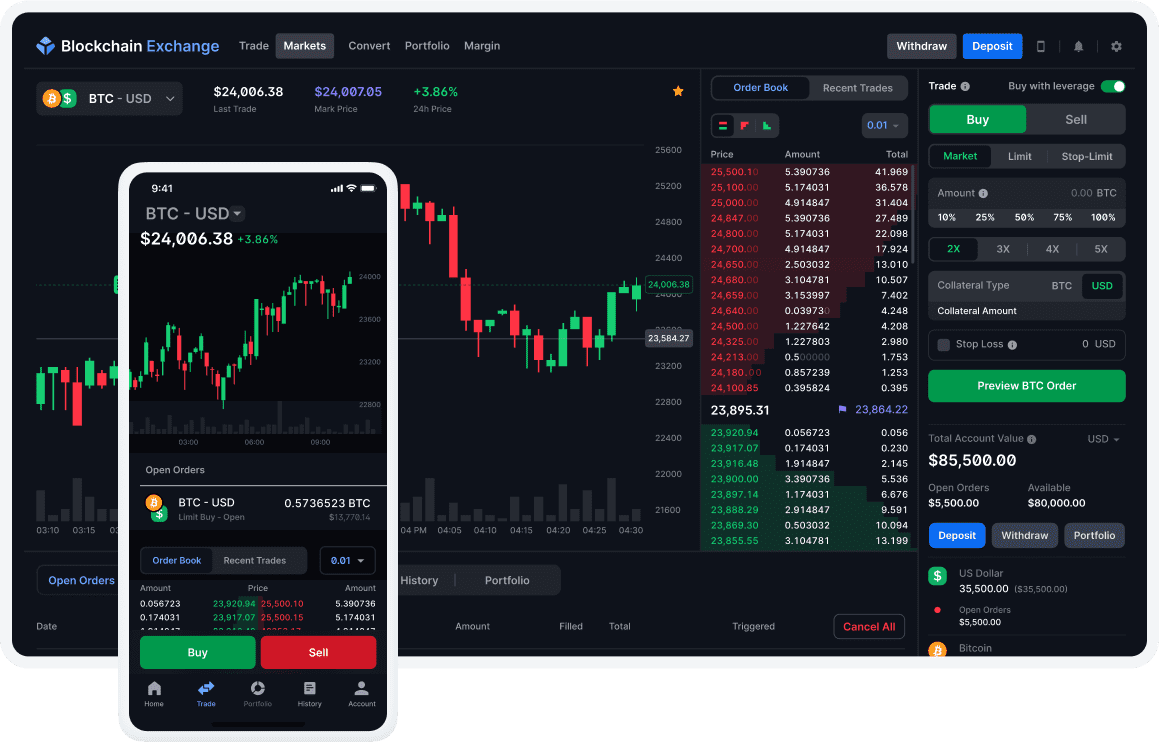

Trading engines are critical in processing transactions swiftly. They match buy and sell orders with precision. A well-built engine minimizes latency and boosts efficiency.

Transactions must execute in milliseconds to meet trader expectations. Every delay can lead to missed opportunities. Thus, optimizing speed and reliability is paramount.

Maintaining accuracy in order matching is essential. Mismatches can lead to significant financial discrepancies. A robust algorithm prevents such errors, ensuring correct executions.

Advanced matching systems include:

- High-speed processing capabilities.

- Fault-tolerant algorithms to prevent errors.

- Real-time monitoring for optimal performance.

- Load balancing mechanisms for sustained efficiency.

These systems must support various order types. This includes market, limit, and stop orders. Flexibility here enhances user experience and engagement.

Cloud vs. On-Premise Solutions

Choosing between cloud and on-premise solutions impacts scalability. Cloud platforms offer flexibility and cost-efficiency. They adapt quickly to changing demands.

On-premise setups provide more control over data. They are preferred where regulations demand strict data residency. However, they can be more costly and less flexible.

Key decision factors include:

- Scalability needs and cost considerations.

- Regulatory requirements for data control.

- Desired level of flexibility and control.

Balancing these factors leads to an informed infrastructure decision. This choice affects the long-term success and adaptability of the exchange.

Ensuring Security and Trust

Security and trust form the bedrock of successful crypto exchanges. A breach can significantly harm your reputation. Therefore, proactive measures are essential to safeguard users' assets.

Crypto exchanges must implement multi-layered security strategies. These strategies protect against cyber threats, fraud, and unauthorized access. Effective systems include encryption, two-factor authentication, and biometric verification.

Trust is built through transparency and accountability. Users need clear communication about security protocols. Regular updates reassure users about the safety of their funds.

Building a culture of security involves engaging employees. Continuous training and awareness programs are vital. They help staff identify and respond to threats effectively.

Key security strategies include:

- Multi-layered protection measures.

- Transparency about security protocols.

- Regular employee training and awareness.

- Implementing strict access controls and auditing.

Security and trust go hand in hand. Together, they ensure the longevity and success of your exchange. Investing in these areas cannot be overemphasized.

Implementing AML and KYC Procedures

Anti-money laundering (AML) and know your customer (KYC) processes are critical. They enhance credibility and compliance with financial regulations. These processes also help prevent illicit activities.

KYC verifies user identities to reduce fraud risks. It ensures that only legitimate users access the platform. Collecting necessary documents helps confirm user authenticity.

AML procedures monitor transactions for suspicious patterns. They detect unusual behaviors that may indicate money laundering. This ongoing vigilance safeguards exchange integrity.

Implement AML and KYC by:

- Verifying user identity with appropriate documentation.

- Monitoring transactions for suspicious activity.

- Complying with global financial regulations.

Together, AML and KYC build a secure trading environment. They uphold legal responsibilities while fostering user trust.7

Ongoing Threat Monitoring and Incident Response

Constant threat monitoring is crucial for a secure exchange. Cyber threats evolve, requiring continuous vigilance. Tools like intrusion detection systems enhance security posture.

Timely incident response minimizes damage from breaches. It involves rapid containment, recovery, and communication. A proactive approach limits potential harm.

Maintaining a detailed incident response plan is necessary. This plan outlines steps for various attack scenarios. Regularly testing and updating the plan ensure effectiveness.

Strengthen security through:

- Continuous threat monitoring systems.

- Rapid and effective incident response plans.

- Regular updates and testing for preparedness.

An adaptive security strategy protects against emerging threats. It bolsters user confidence and promotes exchange credibility.

Crypto Guides

Does the crypto market close | Best Crypto Hardware Wallet | Is dogen Crypo legit | How to buy RXS Crypto | What is a ticker in Crypto | How to buy Crypto on malcoin | Is the signature same as a transaction ID in Crypto | What do the multipliers in Crypto contracts mean | What is spot trading in Crypto | Is staking and delegating Crypto the same thing | Can a Bangladeshi National Hold Crypto

Liquidity: The Lifeblood of Crypto Exchanges

Liquidity is crucial for the smooth functioning of crypto exchanges. It affects trade execution and price stability. High liquidity assures traders of competitive pricing and minimal slippage.

To foster liquidity, exchanges need a healthy influx of buyers and sellers. This balance supports quick trade execution. Establishing a dynamic trading environment is vital.

Enhancing liquidity requires strategic planning. Exchanges can implement several strategies. These strategies include offering incentives to market makers.

Building liquidity involves:

- Encouraging active participation through low fees.

- Rewarding users with loyalty programs.

- Partnering with liquidity providers to ensure availability.

A liquid market attracts high-volume traders. It also increases trust among users. Therefore, liquidity is not just beneficial but essential for growth.

Market Making and Liquidity Partnerships

Market making is key to maintaining liquidity. Market makers provide constant buy and sell orders. This activity ensures a stable market environment.

Liquidity partnerships further enhance this stability. Collaborating with established firms increases available capital. These partnerships improve order book depth.

Here’s how to cultivate liquidity:

- Form strong partnerships with reputable market makers.

- Provide incentives for continuous market participation.

- Optimize your trading environment for seamless transactions.

These efforts establish a vibrant trading platform. They ensure your exchange operates efficiently and attractively.

Expanding Trading Pairs and Asset Listings

Expanding trading pairs boosts user engagement. More options mean users find suitable trades. This variety enhances user satisfaction and market activity.

Adding new assets requires thorough assessment. Security, demand, and regulatory compliance must be considered. Proper evaluation prevents potential complications.

For a richer user experience, consider:

- Regularly assessing potential new crypto assets.

- Ensuring compliance with legal and security standards.

- Offering diverse trading pairs to meet user needs.

By broadening trading opportunities, exchanges enhance liquidity. This expansion fosters a dynamic and appealing market environment.

User Acquisition, Retention, and Growth Marketing

Growing a crypto exchange business requires focused marketing strategies. User acquisition starts with understanding the target demographic. Effective campaigns are tailored to attract this audience.

Retention is equally important as acquisition. Keeping users engaged saves costs on new acquisitions. It also builds a loyal community around your platform.

Growth marketing combines analytics with creative strategies. Data-driven insights help in adapting campaigns. They ensure consistent user growth and satisfaction.

Key strategies include:

- Leveraging social media platforms for brand visibility.

- Regularly updating content to keep users informed and engaged.

- Utilizing email marketing to share offers and updates.

Offer promotions to capture interest and build initial engagement. These can be pivotal in attracting new users. Monitoring results is essential for optimizing future campaigns.

Engage users with informative content and responsive support. This engagement enhances user trust and retention. A well-rounded marketing approach leads to sustained growth.

Optimizing User Experience (UX) and Interface (UI)

Enhancing UX/UI is crucial for user satisfaction. A seamless interface invites more engagement. Users prefer platforms that are easy to navigate.

Key areas to focus on include:

- Ensuring responsive design for various devices.

- Simplifying access to core features for user efficiency.

- Providing personalized interfaces for enhanced usability.

Regular feedback is essential for UI optimization. User feedback helps identify pain points. It guides necessary adjustments for improved experience.

A user-centric design boosts satisfaction and loyalty. This strengthens your exchange’s competitive position. Focused UX/UI efforts are key to success.

Referral, Affiliate, and Community Programs

Referral programs drive growth through user advocacy. Incentives motivate users to bring in new participants. This adds a personal touch to user acquisition.

Affiliate marketing expands your reach. Partners promote your platform to wider audiences. They leverage their networks to attract users.

To enhance these efforts:

- Design attractive and clear reward structures.

- Partner with influencers aligned with your brand values.

- Foster a vibrant community through engaging activities.

Community programs build a sense of belonging. They enhance user involvement and encourage advocacy. This social proof further strengthens brand trust.

Customer Support and Community Engagement

Exceptional customer support is vital in the crypto exchange landscape. Users expect timely and effective responses to their queries. Support services play a crucial role in maintaining customer satisfaction.

Community engagement is equally important for brand reputation. Creating a community fosters trust among users. It encourages feedback which is instrumental for growth.

Consider implementing the following strategies to enhance support and engagement:

- Provide 24/7 support to address global users’ needs.

- Utilize chatbots for quick and initial interactions.

- Host webinars and Q&A sessions for education and interaction.

Engaging actively with the community can turn users into advocates. Their positive experiences and testimonials boost credibility. This creates a strong network effect, attracting more users to your exchange.

Data Analytics and Decision-Making for Growth

Data analytics is a cornerstone of successful crypto exchanges. Through insightful data, you can understand user behavior and market trends. This understanding enables informed decision-making.

Utilizing data effectively can lead to substantial growth. It helps identify which features users value most. You can then focus resources on enhancing these areas.

Consider the following methods to leverage data analytics:

- Implement user activity tracking to monitor engagement.

- Analyze trading patterns to identify market shifts.

- Use data visualization tools to present actionable insights.

By interpreting data accurately, businesses can anticipate user needs. This foresight helps in preempting market demands. Ultimately, a data-driven approach strengthens competitive advantage and fosters long-term growth.

Strategic Partnerships, Integrations, and Expansion

Strategic partnerships are crucial for scaling a crypto exchange. Partnerships can enhance product offerings and broaden your market reach. Engaging with the right partners adds immense value.

Integrations with other platforms can also boost exchange functionalities. They enable seamless transactions and improved user experiences. Make integration decisions that align with your business goals.

Consider the following for effective partnerships and integrations:

- Collaborate with liquidity providers for better market depth.

- Partner with fintech companies to offer additional services.

- Integrate with wallet services for easy asset management.

Expansion into new markets is another growth strategy. Assess potential markets for their viability. This ensures that you're tapping into regions with high demand.

Successful expansion requires understanding local regulations and consumer behavior. Tailor your offerings to meet these localized needs. It’s a step towards building a robust global presence.

Internationalization and Localization

As you expand internationally, localization becomes key. This involves adapting services to suit local cultures and languages. It ensures relevance in diverse markets.

Internationalization helps position your exchange globally. It involves creating scalable systems that support multiple languages and currencies. This capability makes your platform more accessible.

Effective international strategies include:

- Translating interfaces and documentation accurately.

- Understanding and complying with regional regulations.

- Offering customer support in local languages.

Localization also fosters deeper connections with users. By respecting cultural nuances, you enhance user trust and loyalty. Both internationalization and localization are critical for sustainable global growth.

Innovation, DeFi, and Future-Proofing Your Exchange

Innovation drives the crypto exchange market forward. Staying ahead means adopting new technologies and trends. Keep an eye on advancements to remain competitive.

Decentralized finance (DeFi) plays a crucial role in this evolution. DeFi offers decentralized alternatives to traditional financial systems. Integrating DeFi features can greatly enhance your exchange's offerings.

Consider embracing these innovative elements:

- Smart contracts for automated trading processes.

- Decentralized trading pairs for more diverse offerings.

- Integration with DeFi lending and borrowing platforms.

To future-proof your exchange, adopt a proactive approach. Anticipate changes in technology and user expectations. Continuously update your platform to address these shifts.

Invest in research and development to explore emerging trends. Building a dedicated innovation lab can foster new ideas. By nurturing a culture of creativity, you position your exchange for long-term success.

Case Studies: Lessons from the Top 10 Crypto Exchanges

Analyzing top crypto exchanges provides invaluable insights. They set benchmarks for performance and user satisfaction. Understanding their strategies can guide your growth efforts.

Top exchanges excel by prioritizing user experience and security. They invest heavily in robust security measures. This fosters trust and encourages user engagement on their platforms.

Many leverage innovative technologies and partnerships. This expands their service offerings beyond traditional crypto trading. Collaborations with fintech firms can enhance their market reach.

Consider these key takeaways from leading exchanges:

- Continuous technology upgrades for scalability and efficiency.

- Expanding services through strategic partnerships and integrations.

- Offering diverse trading pairs to attract a broader audience.

Also, these exchanges focus on regulatory compliance. Adhering to legal standards ensures credibility and stability. Staying informed about global regulations helps them navigate challenges.

By studying these successes, you gain a roadmap for scaling. Tailor these strategies to fit your exchange's unique goals. Adaptation is key to thriving in a dynamic market.

Best Practices and Actionable Tips for Scaling

Scaling a crypto exchange requires a strategic approach. Focus on creating a strong foundation with proven best practices.

First, prioritize technology upgrades. Invest in scalable infrastructure to support growth. This ensures your platform can handle increased traffic efficiently.

Next, enhance user engagement through targeted marketing efforts. Build brand loyalty with consistent communication and rewards. User-focused strategies are vital for retention and expansion.

Additionally, streamline operational processes to improve efficiency. Automate routine tasks to free up resources for innovation. Operational efficiency boosts your exchange's capacity to scale rapidly.

Consider these actionable tips:

- Monitor and adapt to market trends for staying competitive.

- Implement robust security measures to build trust.

- Foster community engagement for insightful feedback.

By integrating these best practices, your crypto exchange will be primed for sustainable growth. Scalability in operations and marketing is crucial for long-term success.

Conclusion: Building a Resilient, Scalable Crypto Exchange

Scaling a crypto exchange involves more than just expansion. It requires building resilience in a competitive market. Focus on technological innovation and market awareness.

Align your strategies with industry trends. Incorporate new technologies and best practices. This adaptability will sustain growth and improve user satisfaction. Read our Hardware Crypto Wallet Guide for everything you need ot know about cold wallets.

Staying ahead needs constant evolution and strategic foresight. Establish a robust framework for continued enhancement. By doing so, your crypto exchange will thrive in an ever-changing landscape. Aim for resilience and scalability to ensure enduring success.